Ethereum’s shortcomings saw the rise of so-called “Ethereum killers,” a wave of blockchains aiming to solve its most pressing challenge: scalability. Among these, Solana emerged as a standout, gaining attention for its lightning-fast transactions and positioning itself as the preferred blockchain for institutional use cases, particularly in payments.

Now, with the landscape shifting, the spotlight is on Solana once again — this time as it faces competition from a new generation of challengers, often dubbed “Solana killers.” Leading this pack are Sui, Aptos, and Sei, each boasting claims of superior scalability and next-gen features that aim to outperform Solana.

Of these next-gen blockchains, Sui stands out, built on the advanced tech once developed for Facebook’s ill-fated Libra project. With its unparalleled scalability and innovative design, Sui is positioning itself as a formidable rival to Solana.

The SECRET Money Making System!

In this article, we’ll take a deep dive into Sui vs Solana, comparing them across key dimensions — from their origins and architecture to their future potential. Can Sui really dethrone Solana, or is Solana too entrenched to be unseated? Let’s find out!

Inception and Team

Let’s explore the inception stories and teams behind Solana and Sui to see how their foundations have shaped their paths.

Solana

Solana was founded in 2017 by former Qualcomm engineer Anatoly Yakovenko, who came up with the concept of Proof of History (PoH) — a technology that allows blockchains to significantly increase scalability without compromising security or decentralisation.

Although Yakovenko initially envisioned Solana as a decentralised competitor to centralised stock exchanges like the Nasdaq, it has since evolved into a general-purpose Layer 1 blockchain. Today, Solana supports a wide variety of use cases, such as gaming, decentralised physical infrastructure (DePIN), and most notably payments, through partnerships with the likes of Visa, Stripe, and Circle, the issuer of USDC.

The Solana blockchain was created by an American software company Solana Labs, and its ongoing development is coordinated by the Solana Foundation, a Swiss non-profit that provides developer grants and support for the Solana ecosystem.

Sui

Sui was founded in 2021 by a group of five individuals: Evan Cheng, Adeniyi Abiodun, Sam Blackshear, George Danezis, and Costas Halkias. What brought them together was their work at Novi Financial, a company responsible for building products for Facebook’s Libra project.

Libra was Facebook’s attempt to launch its own fiat-backed stablecoin and banking system in 2019, which immediately faced immense regulatory scrutiny from governments worldwide.

In 2020, Libra shifted its focus and rebranded to Diem in hopes of easing regulatory pressures, but it was ultimately shut down in 2022. Despite its failure, Libra provided developers with unlimited resources to develop cutting-edge technology — notably the Move programming language, which we’ll delve into later. This technology is now utilised by both Sui and Aptos, with Aptos’ founders also having worked on Libra.

Speaking of which, we also have an in-depth review of Aptos that you can check out here.

Sui is developed by Mysten Labs, a software company based in Palo Alto, California, that works on both Sui and the Move programming language. Its ongoing development is coordinated by the Sui Foundation, a non-profit based in the Cayman Islands.

Mainnet and Funding

Here’s a look at Solana and Sui’s mainnet rollouts and the funding that has fueled their rise.

Solana

Solana’s mainnet launched in 2020 and is still technically in development. It will be considered complete after the successful rollout of the Firedancer validator client, which aims to significantly increase Solana’s scalability and decentralisation — more on that later.

Funding

Solana raised $25 million across multiple ICOs held in 2018, 2019, and 2020. What’s particularly notable is that Solana managed to secure an additional $314 million in 2021. It’s quite rare for a crypto project to raise additional funding post-ICO, highlighting the strong confidence investors had in Solana.

However, this achievement was somewhat overshadowed by the collapse of its two largest investors, FTX and Alameda Research, in November 2022. Moreover, Solana essentially served as the de facto exchange chain for FTX, with both firms heavily invested in Solana’s ecosystem. As a result, Solana was hit especially hard by these events.

Sui

Sui’s mainnet launched in 2023 and is also technically still in development.

Funding

Sui raised $336 million across two funding rounds in 2021 and 2022. Like Solana, FTX was one of Sui’s biggest backers, contributing $100 million to the total funding. On the positive side, Mysten Labs was able to buy back FTX’s stake from the bankruptcy estate in 2023.

Technology

As is the case with all cryptocurrencies, the technology powering Solana and Sui is incredibly complex. However, the main merit of both projects lies in their promise to deliver hundreds of thousands of transactions per second (TPS) with fast transaction finality, all while remaining highly secure.

In contrast, Ethereum’s base chain is currently processing 12.14 transactions per second, with transaction finality taking up to 16 minutes, according to Chainspect.

That said, let’s take a closer look at how Solana and Sui achieve impressive scalability.

Solana’s Proof of History and Firedencer Validator Client

Solana utilises a Proof-of-Stake (PoS) blockchain with a unique component called Proof of History (PoH). In a nutshell, PoH timestamps transactions on the blockchain to prove they occurred at a specific point in time. This enables Solana to process thousands of transactions in parallel because validators don’t have to wait for block confirmations to verify the order of transactions.

This combination of PoS and PoH allows Solana to theoretically handle up to 200,000 transactions per second, a number that could significantly increase once the Firedancer validator client goes live on the mainnet.

Firedancer

The significance of Firedancer lies in its introduction of sharding, a horizontal scaling technique that splits the network into smaller, more manageable chains, allowing different sections of the blockchain to process transactions simultaneously. In theory, Firedancer could enable Solana to achieve up to 1 million TPS, which is expected to go live sometime in 2025.

Solana’s Programming Language

Solana uses Rust as its primary programming language for smart contracts. However, Rust has become one of Solana’s biggest hurdles, as coding on the network is apparently very difficult.

Unlock Financial Freedom! Start Today >>

That’s also one of the main advantages of the “Solana killers,” namely that they offer a much more pleasant developer experience compared to Solana.

Account-Based Model

Understanding Solana’s account-based model helps compare it to traditional banking. When you transfer funds from your bank account, the bank, acting as a third party, tracks your balances and ensures you can’t spend more money than you have.

Similarly, most smart contract cryptocurrencies use account-based models to manage balances and transactions, but without the need for a central authority. While Solana’s account model isn’t particularly unique in this regard, what sets it apart is its ability to process transactions in parallel. In contrast, Ethereum processes transactions sequentially — one at a time — which contributes to its high gas fees during periods of heavy network demand.

That said, Solana isn’t immune to congestion problems.

During the memecoin frenzy of early 2024, the rapid surge in demand caused the Solana blockchain to experience severe slowdowns, with up to 75% of transactions failing, effectively making the network unusable for a time. While these disruptions weren’t entirely due to Solana’s account-based model, other technical challenges have also contributed to its reputation for network outages. Fortunately, full network outages have become much less frequent in recent years

Sui’s Object-Based Model and Move Programming Language

Sui operates on a Delegated Proof-of-Stake (DPoS) blockchain, capable of processing up to 297,000 transactions per second, which currently surpasses Solana.

Notably, only complex transactions, such as smart contract executions, require consensus. In contrast, simple transactions, like token transfers, are processed quickly and in parallel without needing full consensus, which contributes to Sui’s impressive speed.

Transaction Finality

One area where Sui clearly ranks superior over Solana is its transaction finality of 390 milliseconds, enabled by its unique consensus protocol, Mysticeti. In contrast, Solana’s transaction finality can take up to 12 seconds.

This is particularly significant, as one could argue that transaction finality is even more important than TPS because it determines how quickly a transaction is actually considered final.

But how does Sui achieve this impressive performance? There are two key components of Sui’s tech stack worth noting: its Object-Based Orientation and the Move programming language.

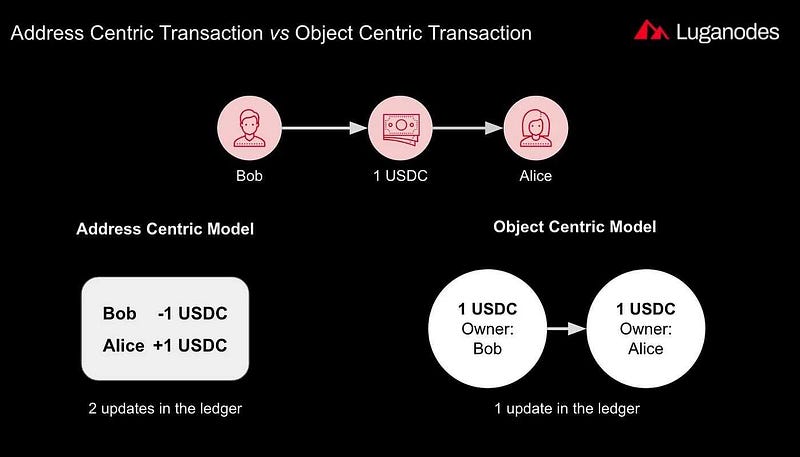

Object-Based Orientation

Account-based models and object-based orientations both serve the same purpose, but they work in different ways. The key difference is that Sui treats every asset on its blockchain as an independent object, which is fundamentally different from cryptocurrencies using the account-based model that is centred around wallets and account balances.

In Sui’s object-based system, assets like NFTs and tokens are treated as standalone objects. This reduces the need to interact with smart contracts every time an object is moved, resulting in lower transaction fees and faster transaction speeds.

You Are Just 3 Steps Away From Success!

While both systems are highly optimised for speed and scalability, Solana’s account-based model can face bottlenecks when multiple transactions affect the same account or wallet, requiring sequential processing.

On the other hand, Sui’s object-based model offers more flexibility by allowing transactions involving different objects to be processed independently, avoiding the bottlenecks that Solana’s account-based model can face when multiple transactions interact with the same account.

Move Programming Language

Sui’s Object-Based System is enabled by the use of the Move programming language, which was developed by the Diem developers and is now also being worked on by Mysten Labs.

What makes Move special is that it’s purpose-built for blockchain, making it highly effective for developing both Sui and DApps within its ecosystem. Rust, however, is a general-purpose language, which contributes to the poor developer experience on Solana.

Furthermore, what makes Sui a direct competitor to Solana is the fact that Move itself is based on Rust, meaning that developers in the Solana ecosystem could easily migrate to Sui or Aptos without needing to learn a new programming language.

Decentralisation and Security

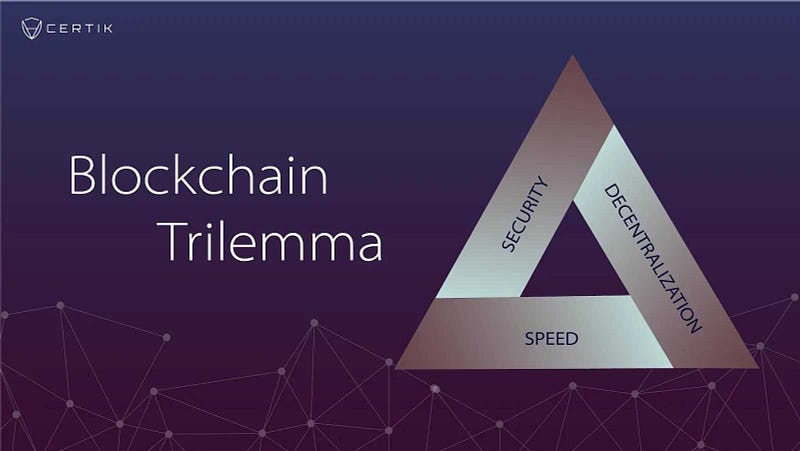

The blockchain trilemma, coined by Ethereum’s Buterin, stipulates that no blockchain can excel in all three areas — scalability, security and decentralisation — without sacrificing the other.

Logically, there must be a trade-off, and in the cases of Solana and Sui, it’s decentralisation. Some would argue that decentralisation is the most crucial aspect of a blockchain, as without it, crypto isn’t much different from its centralised counterparts.

Let’s now examine how decentralised Solana and Sui truly are.

Solana

Solana currently has around 1,400 validators, which at first glance suggests a high level of decentralisation. However, this is somewhat mitigated by the fact that transactions are processed by a smaller subset of approximately 30 validators, known as clusters, which are randomly selected from the total pool of validators.

Validator Requirements

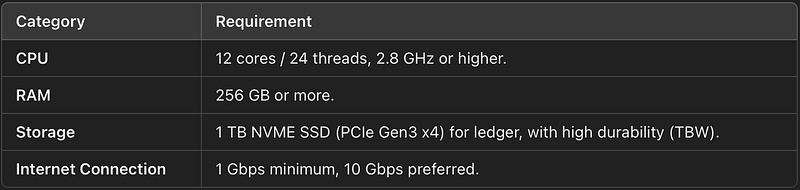

Becoming a validator on Solana involves meeting quite high hardware requirements, which in itself is a significant barrier to entry:

There is no minimum stake required to become a validator. However, in practice, a competitive amount of stake is necessary to remain profitable. This typically means ranking among the top 1,000 validators to have a chance to produce blocks and earn rewards. Fortunately, delegation is enabled.

The staking rewards for validators and delegators are currently around 6.5%, with a 3-day lockup period. If you’re looking to stake your SOL, it can easily be done through Solana’s most popular wallets, such as Phantom and Solflare, among others. Note that slashing is enabled.

Validator Clients

One impressive aspect of Solana’s validator clients — which enable validators to interact with the blockchain — is the fact that Solana has two validator clients, with three more on the way. This greatly reduces the risk associated with relying on a single validator client, a significant point of centralization with most other L1s in the space, including Sui.

Storing Full Transaction History

The full transaction history of Solana is stored by archival nodes that maintain complete records of all transactions on the Solana blockchain. The caveat is that this data is stored on Google Bigtable, a centralised server, making it vulnerable to a single point of failure.

However, this is not unique to Solana. In fact, most crypto projects store their transaction histories on centralised servers, which poses a significant concern for the space as a whole. These centralised storage providers could, in theory, withdraw their support for crypto at any moment, without there being enough decentralised storage protocols that could handle all of the newly created demand.

Sui

As you might expect, Sui also has its own degree of centralization.

To begin with, Sui currently has only 108 validators. This is due to multiple factors, the most significant being the requirement of staking 30 million SUI ($60.6 million as of Oct. 22, 2024) to become a validator on the network. As you can imagine, this is a substantial barrier to entry. Thankfully, delegation is possible, and the hardware requirements are not as high as those on Solana.

Staking rewards currently stand at around 3.3%. If you’re looking to stake your SUI, it can easily be done using the Sui native wallet or most other popular wallets in the ecosystem. Keep in mind that slashing is enabled.

Storing Transaction History

Like Solana, Sui’s full transaction history isn’t stored by validators but by full nodes, which are responsible for maintaining the entire blockchain’s transaction history. The number of full nodes on Sui is currently unknown, but it’s worth noting that this figure was close to 2,000 before experiencing a significant decline until the metric was removed completely from the SuiScan Explorer.

Your Investment Is Completely Risk-Free

This is likely because, in order to increase scalability while maintaining high levels of security, decentralisation must be sacrificed, per the blockchain trilemma. As Sui gained traction, having a lot of full nodes requires more communication between them, which could contribute to reduced scalability and potential network congestion.

This has led some to argue that achieving maximum possible scalability is fundamentally a race to the bottom, as sacrificing decentralisation undermines the core principle that differentiates crypto from centralised systems in the first place.

Walrus

Sui is making efforts to decentralise the way full transaction history is stored on its blockchain through Walrus, a decentralised storage and data availability protocol. Currently, full nodes on Sui, like those on Solana, store the transaction history on centralised servers, primarily through partnerships that Sui has established with AWS and Alibaba Cloud.

Tokenomics

In this section, we’ll explore how SOL and SUI are structured and where you can buy them.

Solana

SOL is the native coin of the Solana blockchain, serving multiple purposes:

- Transaction Fees: SOL is used to pay transaction fees on the network.

- Staking: Both validators and delegators can stake SOL to help secure the network and participate in the consensus process.

- Governance: While full governance features are still developing, SOL holders are expected to participate in on-chain governance decisions in the future.

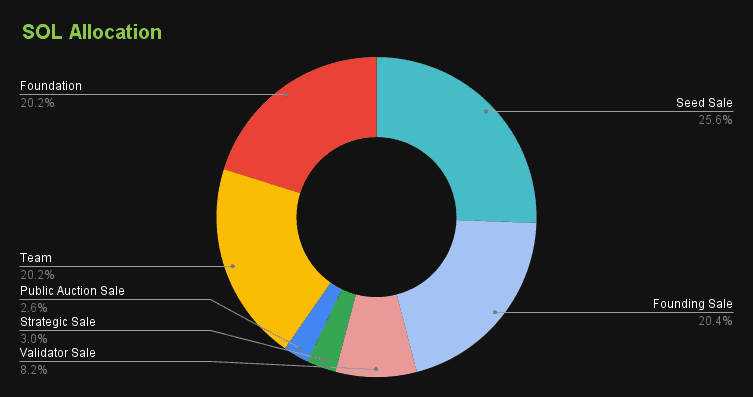

Initial Distribution & Vesting

Solana had an initial supply of 500 million SOL, distributed as follows:

- Seed Sale: 25.6%

- Founding Sale: 20.4%

- Foundation: 20.2%

- Team: 20.2%

- Validator Sale: 8.2%

- Strategic Sale: 3.0%

- Public Auction Sale: 2.6%

To summarise, 60% went to investors, 20% to the team, and 20% to the Solana Foundation. This initial distribution faced significant criticism due to concerns that early investors and the team could hold outsized influence over governance decisions and the network’s future direction.

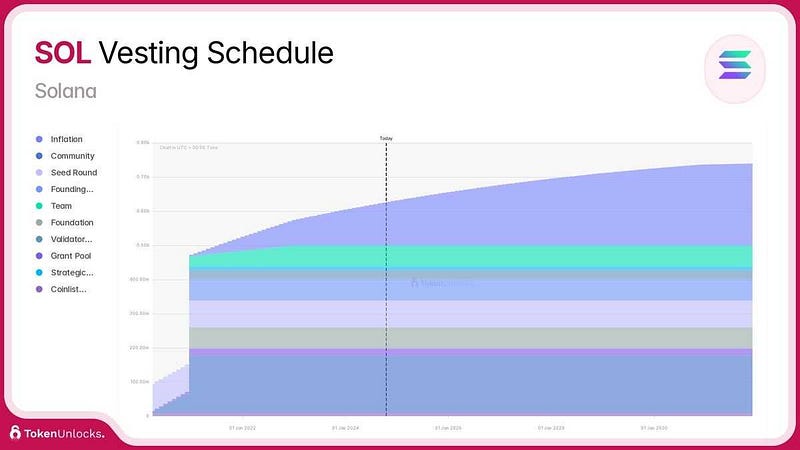

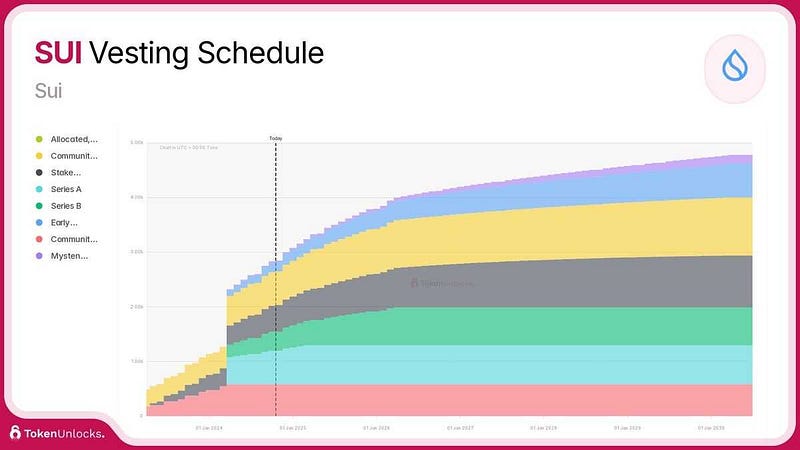

Another point of controversy was Solana’s vesting schedule, which was one of the most aggressive seen in crypto space at the time. The graph below speaks for itself.

In January 2021, 90% of the initial supply was unlocked with many anticipating a crash in Solana’s price due to investors holding 60% of the total supply alone. Contrary to these expectations, SOL went on to achieve an astounding 90x increase by the peak of the 2021 bull run.

Where to Buy SOL

SOL can be purchased on most major centralised crypto exchanges, including Coinbase, Binance, Kraken, OKX, ByBit and BloFin. Additionally, you can check out our top picks for the best crypto exchanges.

For those looking to buy SOL on a decentralised exchange, Raydium is one of the leading DEXs on the Solana network.

Sui

SUI is the native coin of the Sui blockchain, serving the following purposes:

- Transaction Fees: SUI is used to pay transaction fees on the network.

- Staking: SUI can be staked by validators and delegators to help secure the network and earn rewards.

- Governance: While governance features are not yet implemented, once activated, SUI holders will be able to participate in the governance of the Sui blockchain.

Initial Distribution & Vesting

SUI has a maximum supply of 10 billion tokens, distributed as follows:

- 50% to community reserves

- 20% to early contributors

- 14% to investors

- 10% to Mysten Labs

- 6% to early participants

Similar to Solana, Sui has a relatively aggressive vesting schedule, with the largest unlock occurring in May 2024, although it was not nearly as aggressive as Solana’s.

Where to Buy SUI

If you’re looking to purchase SUI, you can easily do so on most major centralised exchanges, such as Coinbase, Binance, Kraken, OKX, ByBit and BloFin.

For those preferring to buy SUI on a decentralised exchange, Cetus is the leading DEX on the Sui network.

Adoption and Ecosystem Growth

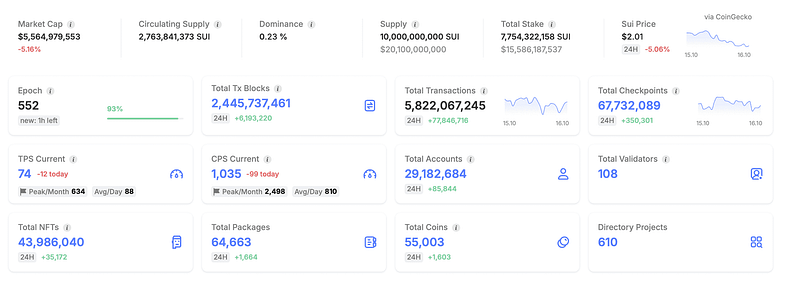

While Solana has been around for longer than Sui, the level of adoption that Sui has already achieved cannot be underestimated. Note that these figures are as of October 2024.

Users and Ecosystem

Let’s have a quick rundown of the user and ecosystem metrics of Solana and Sui:

Solana

- Wallet Downloads: Phantom and Solflare, two of the most popular Solana wallets, have a combined total of around 4.6 million downloads. For more, check out our picks for the top Solana wallets.

- Active Users: Solana has close to 5 million daily active wallets, according to Solscan Explorer.

- DApps: There are 334 decentralised applications (DApps) on Solana, according to DappRadar.

- DeFi: Solana’s DeFi protocols hold around $6.5 billion in total value locked (TVL), according to DeFiLlama.

- Developer Activity: Solana has around 664 full-time developers, accounting for a portion of the roughly 2,800 monthly active developers, per the Electric Capital Developer Report.

Sui

- Wallet Downloads: Sui’s native Sui wallet and Suiet wallet have a combined total of 1 million downloads.

- Active Users: Suiscan suggests that Sui has 5 million monthly active wallets, but this figure is likely closer to 1 million, according to SuiVision, which shows that Sui DApps have around 1 million monthly active users.

- DApps: Sui has around 90 DApps, according to SuiVision.

- DeFi: Sui’s DeFi protocols hold over $1 billion in TVL, according to DeFiLlama.

- Developer Activity: Sui has 204 full-time developers, making up a portion of the approximately 1,100 monthly active developers, according to the Electric Capital Developer Report, which is impressive given Sui’s relatively smaller size compared to Solana.

This highlights that even though Sui is relatively new to the space, the level of adoption it has already achieved cannot be understated.

Hardware Ventures

Both projects are clearly looking to attract adoption through hardware products — Solana with its mobile devices and Sui with its SuiPlay0x1 Handheld Gaming Device. Let’s explore how successful they’ve been in this regard.

Solana: Mobile Devices

Solana launched its first Saga phone in 2023 with built-in crypto and blockchain capabilities. The phone offered features such as a built-in crypto wallet, DApp support and an NFT marketplace.

Initially, the Saga phone struggled to gain adoption. However, in August 2023, Solana reduced the phone’s price from $999 to $599 and included airdrops such as BONK, essentially making the phone free once the airdrops were claimed. This led to the Saga phone selling out in just a week.

The latest version of Solana’s mobile device, called the Seeker, was announced in September 2024 with a $450 price tag, already seeing more than 140,000 preorders — impressive, to say the least.

Sui: SuiPlay0X1 Gaming Device

The SuiPlay0x1, a Web3 handheld gaming device powered by Sui, was launched for pre-orders in September 2024. It integrates both Sui blockchain games and traditional platforms like Steam and Epic Games, offering a seamless gaming experience for both Web2 and Web3 users.

On the adoption side, SuiPlay0X1 saw 2,000 pre-orders after two weeks of its launch. While this isn’t a lot compared to Solana’s Saga phone, it’s important to note that gaming devices are a relatively niche industry. Additionally, Sui is much smaller than Solana, which limits the capital available for marketing and similar efforts.

Institutional Interest

It’s well known that Solana is a favourite among institutional investors, especially in the US, whereas Sui seems to be more focused on Asian markets. You’ll understand why that’s significant in a bit.

Solana

As mentioned earlier, Solana is famous for securing important partnerships, particularly in the realm of crypto payments. Some notable collaborations include:

- Visa partnered with Solana in 2023 to enable stablecoin settlements for cross-border payments.

- PayPal integrated its PayPal USD (PYUSD) stablecoin with Solana in 2024.

- Solana was once named the official blockchain for Circle’s USDC, with Circle’s new Euro stablecoin (EURC) being natively issued on the Solana blockchain.

These developments have fueled speculation that Solana could be next in line for a Spot Solana ETF, following the approval of Ethereum Spot ETFs. While this is unlikely to happen in the short term, it could occur sooner than many would expect, given the clear uptrend in the number of pro-crypto politicians in the US.

Sui

Meanwhile, Sui is clearly more focused on the Asian region. You don’t have to look any further than some of the recent partnerships Sui has secured for evidence of that:

- NHN, a major Chinese gaming company, has partnered with Sui to develop and deploy blockchain-based gaming applications on the Sui blockchain.

- Alibaba Cloud announced support for Sui’s blockchain by deploying full nodes using Alibaba Cloud.

- BytePlus, the enterprise technology arm of TikTok’s parent company ByteDance, has partnered with Mysten Labs to integrate its cloud-native data warehousing solutions, boosting Web3 gaming and SocialFi applications on the Sui blockchain.

This is why one could argue that the real “Solana killers” are actually Sei and Aptos, as both are so-called onshore cryptos, meaning they are primarily aligned with US interests. In contrast, Sui is primarily focused on the offshore crypto industry, with a strong emphasis on the Asian market and, to a lesser extent, the US.

Challenges Facing Solana and Sui

While both Solana and Sui have incredible potential, they also face their fair share of challenges.

Solana’s Challenges

Outages and Network Congestion

The most significant challenge Solana has faced over the years is its network outages, which admittedly have become a lot less frequent, with only one outage in both 2023 and 2024, at least so far.

However, Solana has still faced severe network congestion issues, such as during the previously mentioned surge in meme coin activity on the network. Not being able to send memecoins is one thing, but if Solana is serious about becoming the go-to Layer 1 blockchain for crypto payments, it must achieve a level of reliability that matches traditional financial systems.

Otherwise, these payment processors will turn to L1s that could offer that reliability — the “Solana killers.”

Competition

It’s important to acknowledge that Sui, Aptos, and Sei have their own challenges, but it’s fair to say they have much less to lose and far more to gain. Not long ago, Solana was one of the few somewhat reliable and highly scalable Layer 1s capable of supporting applications like payments. However, that’s no longer the case.

Every outage and congestion issue that Solana faces in the future could push institutions to migrate to other more reliable and scalable blockchains. What’s more, as Sui and Aptos gain traction, many Solana developers could look to migrate to the Move-based blockchains, which you recall are based on the same programming language as Solana. Combine that with the significant funding and adoption these chains are receiving, and this shift could very well happen.

Sui’s Challenges

The Move Programming Language

While Move is arguably Sui’s greatest advantage, it could also present certain challenges. The reason is that Move hasn’t been battle-tested in the same way Rust has. Although Solana’s use of Rust has its disadvantages, these are at least well-known. Move, on the other hand, may have issues or limitations that have yet to be discovered, and it’s likely only a matter of time before some of these come to light.

Regional Focus and Competition

As mentioned earlier, Sui poses perhaps the smallest threat to Solana among the so-called “Solana killers,” primarily due to its focus on the Asian markets. This regional focus could be either a significant advantage or a potential disadvantage, as much of Sui’s success depends on factors beyond its control.

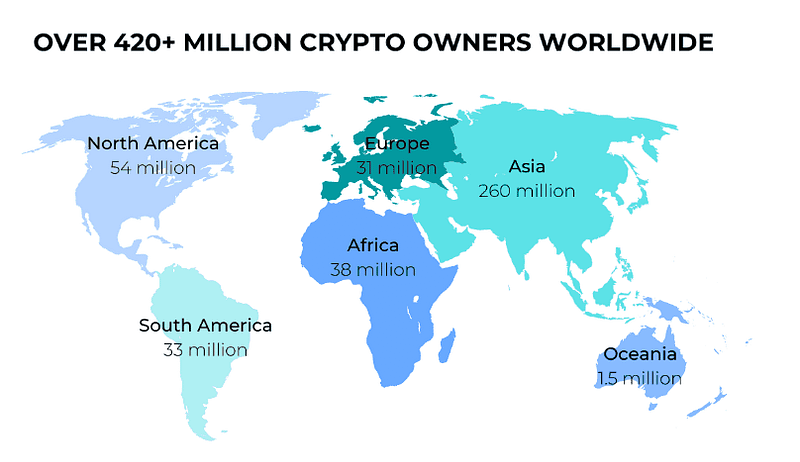

More than 50% of global crypto users are based in Asia, making it a huge market. Sui is arguably positioning itself as the go-to Layer 1 blockchain for the region. However, this could turn out to be a double-edged sword, as one could argue that Sui’s ultimate success in the region hinges on China’s stance on crypto.

If China were to adopt a more pro-crypto position, Sui could capture a significant portion of the market share in the region. On the contrary, if China maintains its hawkish stance, Sui could fall behind other ‘Solana killers’ simply because it wouldn’t find enough adoption.

Fortunately for Sui, recent moves from China have left the impression that the country is slowly but surely opening up to crypto. What remains to be seen, however, is whether this trend will truly continue.

Unlock Financial Freedom! Start Today >>

Sui vs Solana: Closing Thoughts

So, which is better — Solana or Sui? It’s not as simple as choosing one over the other.

While both Solana and Sui aim to become the most scalable Layer 1 that supports a wide variety of applications, the truth is that in the long run, there likely won’t be just one blockchain that dominates the scalability race.

That’s simply because no single blockchain can support all the diverse applications that will emerge in the coming years. This is the entire ethos behind Cosmos and its application-specific blockchains, one of which is Sei.

Additionally, with Solana and Sui clearly focused on different markets and narratives, it’s very possible that these two highly scalable Layer 1s will coexist in the future, each focusing on their specific use cases rather than directly competing with each other.

Ironically, this might be the best outcome, as having a single blockchain win it all would make crypto highly centralised. The competition and eventual coexistence of Solana and the “Solana killers” would benefit the industry as a whole and help preserve the decentralised ethos that crypto was built upon.